34 Cost & FinTech Specialists to Observe in 2022 and past

Up to date in January, 2022

There may be a lot innovation and digital transformation occurring within the funds trade, and it could get difficult to remain updated with the most recent developments.

And one of many quickest methods to maintain ourselves knowledgeable is by following the appropriate individuals on social media. They share all the most recent insights, updates, and information from the cost and FinTech trade.

On prime of this, social media platforms can give you the possibility to work together with specialists out of your trade, trade ideas and methods associated to every little thing payment-wise, and even kind new connections.

Whether or not you’re simply beginning out within the funds and FinTech trade and in search of some steering, or just need to keep up to date with every little thing recent within the trade, following the specialists on social media is your go-to step.

So, get your telephones and social accounts prepared for a following session, as a result of listed here are a few of our favourite prime Funds and FinTech influencers to observe this 12 months (in alphabetical order):

1. Alex Jiménez

Alex Jiménez is a Chief Technique Officer at Finalytics.ai and Extractable. Previous to his present position, he was a Vice President and Senior Strategist at Zions Bancorporation, the place he led the general know-how funding planning course of for the workplace of the CIO.

His different current expertise consists of creating and managing Digital Banking and Funds Technique at Rockland Belief, a group financial institution in Jap Massachusetts. He additionally served because the Chair of the Shopper Bankers Affiliation’s Digital Channel Committee, and not too long ago, he was a member of the American Bankers Affiliation’s Fintech Committee.

Observe him on: Twitter | LinkedIn | Web site

2. Arin S

Arin is a Senior Enterprise Guide at StealthMode Startup with over 18 years of expertise in driving business targets, new market growth, main and managing diversified Monetary Providers. He has in-depth data of funds, cost strategies, and the web gaming enterprise.

Observe him on: Twitter | LinkedIn

3. Invoice Sullivan

Invoice Sullivan is a globally acknowledged FinTech influencer, with common talking appearances at main trade conferences and plenty of interviews with tier 1 and commerce media. He was additionally the Vice President – World Head of Monetary Providers Market Intelligence at Capgemini.

Observe him on: Twitter | LinkedIn

4. Bradley Leimer

Bradley Leimer is Co-Founding father of Unconventional Ventures, which connects founders to funders, supplies mentorship to entrepreneurs, advisory to corporates, and broadens alternatives for range inside the ecosystem. Bradley writes and speaks about banking and know-how developments and advises corporates, startups, accelerators, and key trade conferences within the monetary providers house.

Observe him on: Twitter | LinkedIn | Weblog

5. Brendan Miller

Brendan is the Head of World Advertising Technique and Operations at Rapyd. Beforehand, Brendan was the Principal Analyst – Digital Enterprise & Funds at Forrester Analysis. He writes largely about retail, eCommerce, FinTech, funds, and FinTech innovation.

Brendan is obsessed with creating technique, positioning, branding, messaging, and campaigns that differentiate, display thought management, and end in income impression.

Observe him on: Twitter | LinkedIn

6. Brett King

Brett King is a world-renowned futurist and speaker, an Worldwide Bestselling Creator, and a media character who covers the way forward for enterprise, know-how, and society. He has spoken in over 50 international locations, at TED conferences, given opening keynotes for Wired, Techsauce, Singularity College, Internet Summit, The Economist, IBM’s World of Watson, CES, SIBOS, and plenty of extra.

He has appeared as a commentator on CNBC, BBC, ABC, Fox, and Bloomberg. He beforehand suggested the Obama administration on Fintech coverage and advises regulators and financial institution boards world wide on know-how transformation.

Observe him on: Twitter | LinkedIn | Web site or subscribe to his Breaking Banks podcast wherever you get your podcasts.

7. Christopher Danvers

Christopher Danvers has labored with Credit score Unions specializing in funds, digital transformation, and monetary know-how for over 15 years. He’s a daily speaker at trade occasions, a contributor of editorial content material to trade publications, and is taken into account an innovator and thought chief. He’s at the moment answerable for product growth and card technique as a Senior Supervisor at Q2 BaaS.

Observe him on: Twitter | LinkedIn

8. Chris Gledhill

Chris Gledhill commonly ranks as #1 prime international FinTech influencer and infrequently speaks and writes about FinTech, Banking, and the way forward for monetary providers. Chris was lead cell architect and led the disruptive innovation labs at Lloyds Banking Group earlier than changing into CEO and Co-Founding father of FinTech startup Secco.

Chris has each a technical & enterprise background with experience spanning a variety of disruptive applied sciences, together with Blockchain, AI, API, Massive Knowledge, Deep Studying, Digital Actuality, CryptoCurrencies, Biometrics, Cell & Wearables.

Observe him on: Twitter | LinkedIn

9. Chris Skinner

Chris Skinner is named an unbiased commentator on the monetary markets and fintech by his weblog, theFinanser.com, because the writer of the bestselling books Digital Financial institution, ValueWeb, and its new sequel Digital Human. In his day job, he’s Chair of the European networking discussion board The Monetary Providers Membership, Chair of Nordic Finance Innovation, in addition to being a Non-Government Director of the Fintech consultancy agency 11:FS.

Observe him on: Twitter | LinkedIn | Web site

10. Dave Heun

With over 30 years of expertise within the newspaper enterprise, Dave Heun at the moment works as an affiliate editor for Arizent, as a part of the PaymentsSource group. Dave writes in regards to the funds trade, bank card trade, cell pay applied sciences, and others. Observe him to get all of the enter and study top-notch finest practices from the cost trade.

Observe him on: Twitter | LinkedIn

11. Dave Maddox

Dave is the Blockchain Go-to-Market Chief at IBM, the place he’s answerable for IBM Blockchain Enterprise Growth for the Monetary Providers Market within the US with a concentrate on Blockchain Enterprise Options.

He has over 25 years of expertise within the data know-how trade, the place he occupied government roles in gross sales administration, enterprise growth, and program growth. As well as, he supplies deep data of the Credit score Card Cost Business and has written IBM papers analyzing the trade for IBM’s Consumer Certification Program at Harvard College.

His specialties are Blockchain Expertise, Cost Processing Techniques, Credit score Card Techniques, Giant Techniques Expertise, and Transaction Techniques.

Observe him on: Twitter | LinkedIn

12. Denise Bahs

Denise Bahs is the President of Spark Corp, the place she makes a speciality of lead era by social media cyber sleuthing and engagement. She has educated a big variety of salespeople within the tech and funds trade on the right way to use social media and digital advertising and marketing to nurture their prospects by the customer’s journey.

Observe her on: Twitter | LinkedIn

13. Devie Mohan

Devie is a FinTech advertising and marketing technique and analysis skilled with years of expertise working with trade giants and startups. She has labored in technique, advertising and marketing, and evaluation roles in corporations like Goldman Sachs, Thomson Reuters, Ericsson, IBM, USAID, and SunTec.

She is a guide and researcher for a number of fintech startups, banking innovation teams, and buyers with a eager understanding of the developments and actions of startups, banks and buyers within the house.

Observe her on: Twitter | Web site | LinkedIn

14. Erin McCune

Erin is a Accomplice at Glenbrook Companions, the place she focuses on shopper engagement in enterprise funds, cross-border transactions, invoice funds, and the intersection of company finance, banking, and ERP/accounting.

Erin has over 20 years of expertise in main more and more advanced cost initiatives for company shoppers, in addition to advising monetary establishments and cost technologists on the event of their cost capabilities. Earlier than becoming a member of Glenbrook, Erin was the founding father of Forte Monetary, a consulting agency.

Her specialties are funds methods, monetary course of enchancment, alternative evaluation, build-buy-partner evaluation, market sizing, aggressive intelligence.

Observe her on: Twitter | LinkedIn

15. Florian Graillot

Florian is a VC investor and Founding Accomplice at astoryaVC investing in early-stage startups in Europe with a concentrate on applied sciences that might construct the following insurance coverage era. He’s an engineering graduate from Telecom ParisTech and enterprise faculty graduate from HEC Paris. Florian commonly writes and tweets about InsurTech, AI, and startups.

Observe him on: Twitter | LinkedIn

16. Gareth Lodge

Acknowledged globally as an professional in every little thing associated to funds, Gareth Lodge supplies his shoppers actionable insights and evaluation, by his analysis, consulting, and talking.

He’s at the moment a funds Senior Analyst and World Lead at Celent, a analysis and advisory agency, specializing in monetary providers. He typically shares insights into how a financial institution processes funds (cost hubs and engines), and the way they transfer and settle the funds (ACH, Wire, Actual-time funds, Swift).

Gareth can also be a widely known speaker and contributor within the funds house, together with retail, company, & card funds, having spoken at occasions comparable to Sibos, EBAday, Nacha, and Money2020.

Observe him on: Twitter | LinkedIn

17. Jim Marous

Jim Marous is taken into account one of many prime 5 most influential individuals in banking and likewise top-of-the-line keynote audio system at trade and company occasions. Recognized for his understanding of the disruption within the banking trade, Marous is the co-publisher of The Monetary Model and proprietor and writer of the Digital Banking Report. Jim speaks on innovation, digital transformation, buyer expertise, advertising and marketing methods, channel distribution, funds, and alter administration.

Observe him on: Twitter | LinkedIn | Web site

18. Jordan McKee

Jordan McKee is a Analysis Director at 451 Analysis, the place he leads the protection of digital funds and oversees all qualitative analysis, market forecasts, buyer surveys, strategic consulting, and go-to-market engagements. His fundamental pursuits are round digital transformation methods for cost networks, issuing and buying banks, cost processors, point-of-sale suppliers, and different funds trade stakeholders.

Jordan was listed on the Digital Transactions Affiliation‘s Forty Beneath 40 record in 2018. He’s regularly engaged by the media to share his insights and has been quoted within the Wall Avenue Journal, New York Occasions, Forbes, TIME, Businessweek, and The Monetary Occasions. As well as, he’s a FinTech Contributor at Forbes.

Observe him on: Twitter | LinkedIn

19. JP Nicols

JP Nicols is a trusted advisor to corporations starting from startups to the Fortune 500, a preferred author, and a top-rated speaker.

He’s the co-founder of FinTech Forge, which helps monetary establishments construct and leverage their innovation capability internally and thru strategic fintech partnerships and investments. He’s typically quoted within the media, and his identify commonly seems on a number of lists as an influential thought chief, however what actually drives him helps individuals flip concepts into outcomes.

Observe him on: Twitter | LinkedIn | Web site

20. Karen Webster

Karen Webster is among the world’s main specialists on rising funds and a strategic advisor to CEOs and Boards of multinational gamers within the funds and commerce house. Because the CEO of Market Platform Dynamics, she works extensively with essentially the most revolutionary gamers within the funds, monetary providers, cell, B2B, digital media and know-how sectors to determine, ignite and monetize innovation.

Karen serves on the boards of numerous rising corporations, serving to innovators develop and implement enterprise methods that drive market adoption for his or her services. She’s additionally the founding father of PYMNTS.com, the trade’s main B2B advertising and marketing platform.

Observe her on: Twitter | LinkedIn

21. Kate Fitzgerald

Kate Fitzgerald is a enterprise journalist with huge expertise in monetary providers and retail, notably funds, emphasizing rising digital and cell cost know-how, apps, chatbots and associated improvements.

She is a Senior Editor at American Banker, the place she shares information and evaluation concerning the digital funds revolution. Previous to her expertise at American Banker, Kate held the position of Rising Funds Editor at FinTech Futures.

Observe her on: Twitter | LinkedIn

22. Matt Oppenheimer

Matt is the co-founder and CEO at Remitly, a cell funds service that permits customers to conveniently make person-to-person worldwide cash transfers. The corporate’s imaginative and prescient is to remodel the lives of tens of millions of immigrants and their households with probably the most trusted monetary providers merchandise on this planet.

Earlier to his expertise at Remitly, Matt Oppenheimer was the Head of Cell and Web Banking Initiatives at Barclays Financial institution Kenya, the place he led the launch of the primary web banking platform for Barclays Financial institution Kenya.

Observe him on: Twitter | LinkedIn

23. Michael Diamond

Michael Diamond is the Senior Vice President and Common Supervisor of Digital Banking at Mitek Techniques. Michael has been within the tech trade for many of his profession and has labored by varied arcs of interactive banking know-how, together with interactive voice response, on-line banking, cell banking, cell funds, and at last, cell verify deposit.

When he’s not working, Michael enjoys writing and public talking, and he’s obsessed with management and innovation, which he writes about on his weblog, michaeldiamond.com.

Observe him on: Twitter | LinkedIn | Web site

24. Nadja Bennett

Nadja has over 13 years of expertise within the cost and fraud trade, each in buying and gateway processing.

Nadja’s experience lies in funds, eCommerce, fraud, FinTech, unified commerce, omnichannel, and multinational commerce.

Observe her on: Twitter | LinkedIn

25. Neira Jones

Neira Jones has greater than 20 years’ expertise in monetary providers and know-how. She is commonly invited to advise organizations of all sizes on funds, cyber-crime, crypto-currency and Blockchain, data safety, laws (e.g. PSD2, GDPR, and many others.) and on digital innovation, the place she strives to demystify the hype surrounding know-how right this moment.

Observe her on: Twitter | LinkedIn

26. Nick Bilodeau

Nick Bilodeau is a monetary providers government and a acknowledged trade influencer with over 20 years of management expertise. His work has included heading advertising and marketing and product growth throughout the funds, banking, insurance coverage, and wealth administration industries. He’s at the moment the Government Director of Quantum.

Observe him on: Twitter | LinkedIn

27. Nicole Baxby

Nicole Baxby is the Vice President of World Buyer Success at Featurespace, the world chief in Enterprise Monetary Crime prevention for fraud and Anti-Cash Laundering. Nicole has over 15 years of expertise within the FinTech trade, and her space of experience consists of buyer success, funds, and international FinTech.

Observe her on: Twitter | LinkedIn

28. Oliver Bussmann

Oliver Bussmann is a Senior Expertise Government with 30+ years of influential management in numerous industries (Excessive Tech and Monetary Service) with UBS, SAP, Allianz, Deutsche Financial institution, and IBM.

Oliver is a thought chief in FinTech, Blockchain, Enterprise Mobility, and Cloud Computing. A pioneer in recognizing developments and using business-building social media methods from the CXO position.

Observe him on: Twitter | LinkedIn | Web site

29. Patricia Hines

Patty Hines has over 20 years of expertise in monetary providers throughout enterprise, know-how, and operations. Her areas of experience embrace corporate-to-bank integration, on-line money administration, supply channels, and buyer relationship administration, together with end-to-end business and small enterprise lending.

Observe her on: Twitter | LinkedIn

30. Sebastien Meunier

Sebastien is a technique guide and professional within the administration of world transformations in monetary establishments. His two key areas of focus are enterprise effectivity and innovation in Finance: he helps banks to remodel their companies, be extra environment friendly at each degree and adapt to the FinTech growth.

Observe him on: Twitter | LinkedIn

31. Simon Taylor

Simon Taylor is the Co-Founder and Blockchain Observe Lead at 11:FS. Simon has been immersed within the know-how of economic providers for so long as he’s been working and is persistently voted probably the most influential individuals in Banking, Insurance coverage, and FinTech by banks, his friends, and numerous trade our bodies.

Observe him on: Twitter | LinkedIn

32. Spiros Margaris

Enterprise capitalist and advisor, Spiros Margaris, is the founding father of Margaris Ventures. He is among the foremost international thought leaders and specialists within the fields of fintech and insurtech. He’s the primary worldwide influencer to attain ‘The Triple Crown’ of influencer rankings by being ranked the worldwide No. 1 FinTech, synthetic intelligence (AI), and blockchain influencer by Onalytica in 2018.

Having launched two startups in New York, together with a pioneer in what would now be termed fintech, Margaris believes that his banking, cash administration, and entrepreneurial expertise assist him higher perceive the challenges that the monetary trade faces and thus devise and help revolutionary options for them. Margaris is a frequent speaker at worldwide fintech and insurtech conferences, and he publishes articles on his innovation proposals, inspirations, and thought management.

Observe him on: Twitter | LinkedIn

33. Todd Ablowitz

Todd Ablowitz is a acknowledged and revered trade chief with practically 15 years of expertise working for the buying and funds trade’s prime manufacturers. As Founder and President of Double Diamond Group LLC, Ablowitz leverages his distinctive abilities, experience, and trade relationships to make sure shoppers obtain their enterprise targets.

Observe him on: Twitter | LinkedIn

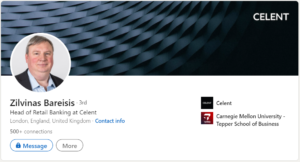

34. Zilvinas Bareisis

Zilvinas Bareisis is the Head of Retail Banking at Celent, the place his analysis is targeted on retail banking applied sciences with a selected emphasis on client and card-based funds and identification and authentication. Zilvinas has over 20 years of expertise advising senior executives at main monetary establishments and their know-how and repair suppliers.

He has a eager curiosity in funds innovation and the way the “excellent storm” of aggressive, regulatory, and know-how developments shapes client funds within the current and future.

Observe him on: Twitter | LinkedIn

We hope that this in depth record of Cost and FinTech specialists will assist you to in your new ventures within the Cost world. And in case you’re solely in search of recent insights and ideas, nonetheless ensure that to observe these specialists, that continually ship information and trade finest practices.

Which different specialists are you following? Tell us within the feedback under!

Wish to study all about on-line cost processing? Try our On-line Cost Processing Information for all of the important recommendations on eCommerce cost processing!

![How to find influencers for your brand [Free & Paid Ways]-TWH](https://tech4seo.com/wp-content/uploads/2024/04/How-to-find-influencers-for-your-brand-Free-Paid-150x150.jpg)